The CA Quarterly Review (Fall 2021)

THE NEWS AND INFORMATION QUARTERLY FOR OWNERS AND AGENTS OF THE PERFORMANCE BASED CONTRACT ADMINISTRATION FOR NEW YORK STATE

- New Application Period for COVID-19 Supplemental Funding

-

The Office of Multifamily Housing published Housing Notice 2021-05, Continued Availability of Funds for COVID-19 Supplemental Payments for Properties Receiving Project-Based Rental Assistance Under the Section 8, Section 202, or Section 811 Programs.HUD is making available CARES Act funds to offset property expenditures to combat the effects of COVID-19. New in this Housing Notice is:

- The timeframe to incur expenses has been extended to a seven month time period from four, allowing owners more time to plan and complete expenditures;

- Funds are available for limited types of capital investments, including HVAC system upgrades, emergency generators and broadband infrastructure;

- A minimum expected funding level is available for each property, allowing owners to be confident that reimbursement will occur at no less than these established levels, and

- A new streamlined prioritization waterfall will allocate all remaining funds across larger requests.

The Housing Notice allows owners to submit payment requests for expenses incurred through October 31, 2021.

Request forms are due to HUD or the Contract Administrator by November 19, 2021.

Property owners and management agents should contact their assigned HUD Account Executive or Contract Administrator with any questions about property eligibility for a CSP.

Read the CSP one pager or press release to learn more.

- HUD Announces Interim Rule Protecting Tenants Facing Evictions for Non-Payment of Rent in HUD-Assisted Properties

In light of the expiring CDC eviction moratorium, HUD published an Interim Rule in the Federal Register on October 7, 2021, to further protect residents. The interim rule is applicable to those HUD properties participating in HUD’s Multifamily Section 8 project-based rental assistance, Section 202, and Section 811 assisted housing programs and HUD-subsidized public housing. In summary, Owner/Agents must provide a 30-day notice period that includes information about federal funded emergency assistance that may be available to impacted residents facing eviction due to nonpayment of rent.

The Final Interim Rule will be effective November 8, 2021 and will ensure that HUD-assisted tenants who are facing eviction for nonpayment of rent have notice of available emergency funds and are given the time to access that assistance.

HUD has also provided H 2021-06, Supplemental Guidance to the Interim Final Rule “Extension of Time and Required Disclosures for Notification of Nonpayment of Rent.” The notice provides supplemental guidance including the required minimum 30-day notification period and other required actions to support families at-risk of eviction for nonpayment of rent. Owners/Agents of Multifamily Properties should reference Emergency Rental Assistance funds.

HUD has outlined the Minimum 30-Day Lease Termination requirements in H 2021-06. The Final Rule extends the notification of nonpayment of rent to at least 30-days, providing additional time for families to be able to secure available funding.

HUD does not prescribe required language for this change in timing of notification to at least 30 days, however Owner/Agents must ensure that notification is provided no less than 30 days prior to any actions to terminate the lease of an affected family. HUD is requiring that Owner/Agents notifications include, at a minimum, the language as provided in the Appendix to H 2021-06 updated with the appropriate link to the local ERA grantee.

- iREMS Compatibility Upgrades

-

HUD has communicated that the iREMS system will soon be upgraded to run on modern internet browsers. With this upgrade, iREMS will no longer function correctly using Internet Explorer, or any other browser running in an Internet Explorer compatibility mode. Users can utilize the following browsers: Edge 94 or above; as well as Chrome 93 or above. - HUD Publishes the FY2022 OCAF & UAF Factors

-

The Operating Cost Adjustment Factors (OCAFs) for fiscal year (FY) 2022 were published on October 4, 2021, in the Federal Register.These factors are used for adjusting cost-adjustment-factors-for-2021 or establishing Section 8 rents under the Multifamily Assisted Housing Reform and Affordability Act of 1997 (MAHRA), as amended, for projects assisted with Section 8 Housing Assistance Payments.

The OCAF factors are effective February 11, 2022.

The 2022 OCAF for NY is: 2.9%

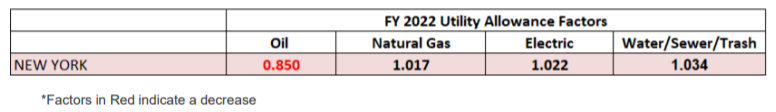

HUD has also published the corresponding FY 2022 UAF factors, which will also be effective February 11, 2022.

- Proactive Pest Control

-

As the leaves start changing and the temperature starts dropping, it’s that time of year when pests, particularly rodents, start gravitating towards the indoors. Although pests can be a problem year round in most places, some specifically move indoors in the Fall and Winter months to stay warm. It would be good practice, if not already done on a regular basis, to perform monthly pest/ housekeeping inspections.

Most properties, such as elderly/disabled buildings, usually engage in monthly or quarterly preventative treatments and pest/housekeeping inspections. One of the main reasons for this is that all residents are not always forthcoming on reporting pest issues for a variety of reasons, such as worried about cost, lease violations, etc. This is a good practice to help identify residents with housekeeping issues that may be lending to the pest problem in the building. This leads to the next issue, hoarding.

The PBCA Call Center receives numerous complaints/inquiries regarding hoarding problems, in all states served, which are contributing to massive pest issues on the properties, and not enough is being done, in some cases, to address these issues. Hoarding things, regardless of what it may be, is also a huge fire hazard and potential liability for management. It also affects the ability for exterminators to properly treat a unit for mice, roaches, bed bugs, etc. Hoarding provides a perfect environment for pests. After a certain point, an exterminator will refuse to even treat an apartment if the housekeeping issues are not addressed by the tenant. So be sure to be proactive and inspect those units!

- The Social Security Administration Announces the 2022 Cost-of-Living-Adjustment

-

The Social Security Administration (SSA) has released its 2022 update that highlights all of the changes to the Social Security program for the upcoming year. Included in this update was the Cost-of-Living-Adjustment, or COLA, which was announced as 5.9% for 2022.The COLA is an annual increase in social security and supplemental security income to account for the inflation faced by beneficiaries in 2021. This adjustment will begin with benefits payable to Social Security and Supplemental Security Income (SSI) beneficiaries in January 2022.

Where Can I Find the Announcement?

The SSA issued a press release announcing the COLA increase for the upcoming year on the SSA’s Cost-of-Living Adjustment (COLA) Information webpage.The announcement was posted to the PBCANY website after the press release was issued by the SSA.

How Does the COLA Effect How I Process Recertifications?

SSA updates to data in the EIV system are only made periodically. Social security benefits that include the COLA are not available from SSA for uploading into EIV until the end of the calendar year.Therefore, when processing recertifications that include social security benefits with an effective date of January 1, February 1, March 1 and April 1, owners must define the manner in which the COLA will be factored into the calculation of the SSA benefit, and the method of verification that will used to support the calculation. In order to complete the recertification steps outlined in Chapter 7 of the HUD Handbook and provide the tenant with the required 30-day notice of any increase in rent, owners must use one of the methods below for determining the tenant’s income:

1. Use the benefit information reported in EIV that does not include the COLA as third party verification as long as the tenant confirms that the income data in EIV is what he/she is receiving;

2. Use the SSA benefit, award letter or Proof of Income Letter provided by the tenant that includes the COLA adjustment if the date of the letter is within 120 days from the date of receipt by the owner;

3. Determine the tenant’s income by applying the COLA increase percentage to the current verified benefit amount and document the tenant file with how the tenant’s income was determined; or

4. Request third party verification directly from SSA* when the income in EIV does not agree with the income the tenant reports he/she is receiving.All recertifications effective after April 1 must reflect the SSA benefit that includes the COLA.

*Requesting Third Party Verification Directly from the SSA

When requesting verification from the SSA, owners must not send the tenant to the SSA office. Instead, the owner must ask the tenant to request benefit information from SSA using SSA’s website or toll-free number.

The owner may assist the tenant in requesting benefit information from SSA, if the tenant requests their assistance in accessing the SSA website or has questions on completing the request.

To obtain benefit information using the SSA’s website:

- Go to the SSA’s website

- Log in to my Social Security to obtain a benefit verification letter.

- A tenant who has not set up an account can easily create one.

To obtain benefit information using the SSA’s toll free number:

- Call the SSA at 1-800-772-1213

- Benefit verification letters may be requested 24 hours a day using the automated telephone service.

- TTY 1-800-325-0778 is available Monday through Friday between 7 a.m. and 7 p.m. for individuals who are deaf or hard of hearing.

- This information is free and the tenant should receive the letter in the mail within 10 days.

The tenant will provide the benefit verification letter to the owner for use in calculating their income. A copy of the letter will be retained in the tenant’s file and the original returned to the tenant for their records.

Changes to Medicare Premiums

For Social Security beneficiaries receiving Medicare, Social Security will not be able to compute their new benefit amount until after the Medicare premium amounts for 2022 are announced. Final 2022 benefit amounts will be communicated to beneficiaries in December through the mailed COLA notice and my Social Security’s Message Center. Information about Medicare changes for 2022, when announced, will be available at www.medicare.gov. Owners must also consider changes to Medicare premiums paid by elderly/disabled families when calculating medical expense deductions.The information contained in this article is found in the HUD Handbook 4350.3 REV-1, Change 4, Chapter 9, Paragraphs 9-6 B.1.e. and 9-15.

- PBCA Member Spotlight

-

Jasmine Grant—NY PBCA Call Center Supervisor

Jasmine Grant—NY PBCA Call Center SupervisorExplain your position with CGI?

I am a Call Center Supervisor for the team in the Albany New York office.How long have you been with CGI?

I’ve been with CGI for 5 years, and 7 months.What was your background prior to joining CGI?

I worked for LexisNexis in the Department for Computer Assisted Legal Research.What are your hobbies? Things you enjoy doing after you leave the office?

I enjoy going to the gym, which is something new for me over the last 5 months. I enjoy spending time with my family and I also enjoy going to the Casino.What brings you the most satisfaction in your day to day tasks?

I enjoy going to the gym, which is something new for me over the last 5 months. I enjoy spending time with my family and I also enjoy going to the Casino.What is the best piece of advice that you could provide to an owner/agent?

The best piece of advice I could give an owner/agent is to document, document, document! - Utility Assistance Programs

-

This article aims to explore how utility assistance programs affect both the Utility Allowance Analysis performed as an integral portion of the annual rent adjustment process and if the utility assistance provided to the household will need to be counted towards annual household income.In today’s economy, tenants have many avenues in which they can request assistance in paying for utility bills. Financial help is provided to pay utility bills by numerous federal and state government organizations as well as charities and utility companies. There are also non-profits that may offer grants for paying a portion of a utility bill and there are solutions, such as payment plans, that are offered directly by utility companies. Many states offer their own energy assistance programs. They go by different names, but seem to be similar to each other. Each will provide assistance to those in need to help them with paying their utility bills. In addition, many states will take a pro-active approach to provide families with ways to save energy.

Most Owners and Agents are likely familiar with the assistance program under the Department of Health and Human Services Low-Income Home Energy Assistance Program (LIHEAP). This is a federal sponsored program where tenants receive a determined amount of assistance based on their income.

A question often asked is how does the program impact the utility allowance analysis and should this assistance be counted as household income? Answers to both of these questions have been addressed in HUD’s FAQ to HUD notice 2015-04.

- When calculating a Utility Allowance that includes a HEAP credit, the credit amount should be added back into the utility bill so that the calculated bill is the actual usage amount before the HEAP credit had been applied. For example, if the usage is $50 and a heap credit of $40 was applied, the total bill would be $10. However, since the FAQ requires one to remove the HEAP credit, the correct calculation for UA purpose is total bill of $10 plus the heap credit of $40 for a $50 total usage to be applied in the UA analysis.

- Per the Federal Register’s current list of federally mandated exclusions from income, assistance under this specific program, LIHEAP, is excluded from income. Therefore, an owner/agent does not count the HEAP assistance when calculating income.

In addition to state/federal funded programs, many utility companies provide assistance to low income households experiencing financial difficulties.

Owner/Agents must be aware of specific programs whether provided by the state or a local utility company to ensure that the Utility Analysis is reported accurately and that income is calculated in the appropriate situations.

For the purpose of this article, we will explore two different examples of utility assistance programs provided to tenants.

Utility Provider Assistance Program

In the first example, a utility company provides a program called the “Energy Affordability Program (EAP)”. While this program is specific to this utility company, other provider sponsored utility assistance programs may function in a similar manner.On Jan. 1, 2018, a new program called the Energy Affordability Program (EAP) was launched to help income eligible customers manage their home energy bills. EAP replaced the Income Basic Service Charge Credit. EAP is automatic for customers that maintain enrollment in the Home Energy Assistance Program (HEAP). Our Utility Company and the State Office of Temporary Disability Assistance, HEAP Bureau, are using a file match to identify customers in our service territory whose HEAP grant has been applied to another utility or fuel vendor account. Customers identified by this file match will be enrolled in the new program.

EAP bill credits are based on the customer’s HEAP benefit. Benefits are structured in a way that gives households with the lowest incomes and the highest energy costs the highest benefit. Income, energy costs, family size and the presence of a vulnerable household member, are all taken into account.

How do I calculate the Utility Allowance?

The HUD notice 2015-04 states “Households receiving utility assistance from sources other than HUD continue to receive the baseline HUD utility allowance as determined by the most recent utility analysis.” Therefore, one must consider if the program in question can be defined as an assistance program available to low-income households. Since EAP is defined as a form of “assistance to low income families”, an O/A should consider this as “assistance” as discussed in the HUD notice and tenants would receive the full benefit of both types of assistance: HUD’s utility allowance and the vendor-sponsored EAP credit. Owner/Agents must remove the credit of EAP when calculating the UA amount. For example: tenants usage is $50 – 47 credit for EAP = a bill total due of $3. The O/A should add back the $47 credit and calculate usage of $50 for the tenant’s bill that month.Do I count this as income?

Households are required to disclose if they are receiving utility assistance from other sources – and this must be counted as income unless excluded by federal mandate (this is not HEAP and it’s not listed as a federal exclusion) click here for a list of federal exclusions.EAP is not listed as a federal income exclusion; therefore, this amount must be counted as income during a recertification interview (the utility bills are the 3rd party verification of the amount). Keep in mind, this question should be a part of the determining income portion of a tenant interview.

Solar Energy Grant Assistance

In a second example of utility assistance, we will consider a Solar Energy Grant called ‘Solar for All.’ This program had been defined as a program that expands solar capacity to increase the amount of solar energy generated to provide the benefits of locally-generated solar energy to low income households, small businesses, nonprofits, and seniors. Participation in the program is voluntary.Upon further exploration, this service had been made available via a grant provided to the multifamily property. The funding was made to the property to install solar panels on the roof of the building which will then reduce the electric bill for all households who chose to participate.

How do I calculate the Utility Allowance?

As this is not a subsidized program for low-income families but rather grant funds provided as a means to reduce the cost of utilities, the consumption amount after the credit should be considered when calculating the UA analysis. For example: usage amount $50 – participation credit of $25 = total bill due $25. The amount used to calculate the UA for this unit should be $25.Do I count this as income?

This solar credit is not a form of assistance to assist low-income households. Therefore, this amount made available to the tenant must not be counted as income. The credit is removed from the UA bill and UA is calculated after the credit is applied and the credit is not considered income.

SUMMARY

As mentioned, each state and utility company may have a similar utility assistance program. Each of these programs may need to be considered individually and Owner/Agents must be aware when conducting the Utility Analysis and reviewing tenant bills. When a credit is reported on a tenants UA bill, Owner/Agents must research what the credit is and act in accordance with the HUD notice and FAQ. A main question to contemplate is the assistance provided to the household considered a subsidized program for Low Income Housing (example #1) or is it a method to reduce utility costs (example #2).

When in doubt, reach out to your Central Contract Specialist for assistance. Additional resources can be found here:HUD Notice 2015-04

FAQ (July 2016)NOTE: The EAP program, the first example discussed, is for properties that can be serviced by National Grid. For more information on the EAP program click here.

- The CA Contact Center

The role of the Contact Center is to support and service our industry stakeholders by addressing inquiries received. The PBCA understands the critical nature of addressing inquiries timely to ensure that prompt resolution is attained. When an industry partner needs assistance, you can reach us by email, phone or fax. The Contact Center will respond promptly to all inquiries with continued followup until we reach an agreed delivered resolution. We achieve these aims by employing three fundamental principles.

The first principle we follow is to facilitate resolutions. Per HUD requirements, PBCAs are expected to respond, research, and communicate reasonable solutions. We fulfill this requirement by ensuring accurate information is documented, verified, and communicated with all interested parties. We do so to provide a full understanding of all reported concerns. Our team employs the use of various research sources such as the CFR, HUD handbooks, HUD notices, state and local laws that inform us of the requirements to maintain compliance and meet guidelines. Ultimately, in our effort to reach a final resolution, we detail the information to all stakeholders and refer them to the applicable guidelines. We then follow-up and verify the appropriate action is taken. This follow-up assists in reducing systemic issues.

Secondly, the PBCA is an industry resource. As a dependable resource, it is imperative that we stay abreast of current housing policies, state and local laws, and notices. In addition, our Training and Compliance team, as well as our in-house experts make themselves available to the industry and to our Contact Center providing periodic industry updates and required training. A critical area in which we focus our efforts is the accuracy and timeliness of addressing health and safety issues. With these foundational pillars, we are able to make ourselves available to the industry in various ways including through our Contact Center, webinars, industry workshops or conferences, and through our PBCA quarterly newsletter.

Thirdly, we foster relationships. In the delivery of the PBCA requirements, there is tremendous value in connecting with all stakeholders. The Contact Center is in a privileged position where we connect with more industry stakeholders than any other group on a given day. Daily we connect with residents, owner/agents, HUD, PHAs, Congressional, state and local officials, and non-industry partners. Therefore, it is important for the Contact Center to calibrate all communications in light of HUD’s goal of providing decent, safe, and affordable housing. Recognizing this critical starting point allows the relationship to grow and develop, as we are focused on the same goal. This allows us to continue year over year to foster excellent relations.

Following these principles, guarantees that stakeholders are provided accurate and timely information. This information reduces the necessity of utilizing other resources in addressing questions or concerns or obtaining a resolution. We take great pride in incorporating this three principle approach and being available as an extended affordable housing resource, supporting stakeholders in delivering on HUD Housing mandates.

- VAWA Regulations—Emergency Transfer Plans

-

Owners must have an emergency transfer plans in place that is based off of HUD’s model emergency transfer plan. The model transfer plan has been published as VAWA Appendix B: Model Emergency Transfer Plan for Victims of Domestic Violence, Dating Violence, Sexual Assault, or Stalking, form HUD-5381. Be reminded that the other VAWA provisions went into effect on 12/16/2016. Although VAWA regulations encompass all HUD housing programs, this article focuses on the requirements of Multi-Family Housing owners.Owners choosing to use the HUD Model Emergency Transfer Plan (form HUD-5381) must understand that the model plan does not contain all required elements of the VAWA Final Rule. Implementing an Emergency Transfer Plan may require revisions to other controlling documents such has the TSP, Waiting List, and/or House Rules.

The model form contains only general provisions of an Emergency Transfer Plan that apply across HUD programs. Adoption of this model plan without further information will not be sufficient to meet an Owner’s responsibility to adopt an emergency transfer plan. Owners must consult applicable regulations and program-specific HUD guidance when developing their own emergency transfer plans, to ensure their plans contain all required elements.

Housing Notice 2017-05 includes a list of best practices Owners should consider when developing their Emergency Transfer Plan.

Owners need to understand the following definitions:

- Internal emergency transfer refers to an emergency relocation of a tenant to another unit where the tenant would not be categorized as a new applicant; that is, the tenant may reside in the new unit without having to undergo an application process.

- External emergency transfer refers to an emergency relocation of a tenant to another unit where the tenant would be categorized as a new applicant; that is the tenant must undergo an application process in order to reside in the new unit.

- Safe unit refers to a unit that the victim of domestic violence, dating violence, sexual assault, or stalking believes is safe.

The emergency transfer plan must provide that a tenant receiving rental assistance, or residing in a subsidized unit, who is a victim of domestic violence, dating violence, sexual assault, or stalking qualifies for an emergency transfer if:

- The tenant expressly requests the transfer; and

A. The tenant reasonably believes there is a threat of imminent harm from further violence if the tenant remains within the same dwelling unit that the tenant is currently occupying; or

B. In the case of a tenant who is a victim of sexual assault, either the tenant reasonably believes there is a threat of imminent harm from further violence if the tenant remains within the same dwelling unit that the tenant is currently occupying, or the sexual assault occurred on the premises during the 90-calendar-day period preceding the date of the request for transfer.

The emergency transfer plan must detail the measure of any priority given to tenants who qualify for an emergency transfer under VAWA in relation to other categories of tenants seeking transfers and individuals seeking placement on waiting lists.

The emergency transfer plan must incorporate strict confidentiality measures to ensure that the O/A does not disclose the location of the dwelling unit of the tenant to a person who committed or threatened to commit an act of domestic violence, dating violence, sexual assault, or stalking against the tenant.

The emergency transfer plan must allow a tenant to make an internal emergency transfer under VAWA when a safe unit is immediately available. The emergency transfer plan must describe policies for assisting a tenant in making an internal emergency transfer under VAWA when a safe unit is not immediately available, and these policies must ensure that requests for internal emergency transfers under VAWA receive, at a minimum, any applicable additional priority that housing providers may already provide to other types of emergency transfer requests.

The emergency transfer plan must describe reasonable efforts that will be taken to assist a tenant who wishes to make an external emergency transfer when a safe unit is not immediately available.

The plan must include policies for assisting a tenant who is seeking an external emergency transfer under VAWA out of the O/A’s program or project, and a tenant who is seeking an external emergency transfer under VAWA into the O/A’s program or project. These policies may include:- Arrangements, including memoranda of understanding, with other covered housing providers to facilitate moves; and

- Outreach activities to organizations that assist or provide resources to victims of domestic violence, dating violence, sexual assault, or stalking.

The plan must not limit a tenant from seeking an internal emergency transfer and an external emergency transfer concurrently if a safe unit is not immediately available.

The emergency transfer plan must be made available upon request and, when feasible, the plan must be made publicly available.

Owner/Agents must keep a record of all emergency transfers requested under the emergency transfer plan, and the outcomes of such requests, and retain these records for a period of three years, or for a period of time as specified in program regulations. Requests and outcomes of such requests must be reported to HUD annually.

The emergency transfer plan may require documentation from a tenant seeking an emergency transfer, provided that:

- The tenant’s submission of a written request to the O/A, where the tenant certifies that they meet the criteria, shall be sufficient

- The O/A may, at its discretion, ask an individual seeking an emergency transfer to document the occurrence of domestic violence, dating violence, sexual assault, or stalking for which the individual is seeking the emergency transfer, if the individual has not already provided documentation of that occurrence; and

- No other documentation is required to qualify the tenant for an emergency transfer.

Updating Policies and Procedures for Transfer Plans

Owner/Agents are encouraged to undertake whatever actions permissible and feasible to assist tenants who are victims of domestic violence, dating violence, sexual assault, or stalking to remain in their units or other units under the covered housing program or other covered housing providers.Owner/Agents are further encouraged to bear the costs of any transfer, unless prohibited by local or state ordinance.

FAMILY, 515/8 and 202/8 PROPERTIES:

In order to facilitate emergency transfers for victims of domestic violence, dating violence, sexual assault, and stalking, The O/A has discretion to adopt new, and modify any existing, admission preferences or transfer waitlist priorities.When a safe unit is not immediately available for a victim of domestic violence, dating violence, sexual assault, or stalking who qualifies for an emergency transfer, The O/A must:

- Review the covered housing provider’s existing inventory of units (Waitlist) and determine when the next vacant unit may be available; and

- Provide a listing of nearby HUD subsidized rental properties, with or without preference for persons of domestic violence, dating violence, sexual assault, or stalking, and

- Provide contact information for the local HUD field office.

202/8 Properties only:

The O/A is responsible for determining whether applicants are eligible for admission and for selection of families. To be eligible for admission, an applicant must be an elderly or handicapped family; meet any project occupancy requirements approved by HUD; meet the disclosure and verification requirement for Social Security numbers and sign and submit consent forms for obtaining wage and claim information from State Wage Information Collection Agencies. - Working Together While Trying to Stay Apart

-

The article title is perhaps the single most poignant comment that encapsulates the majority of responses. The comments included in this article characterize the thousands of comments provided.

The article title is perhaps the single most poignant comment that encapsulates the majority of responses. The comments included in this article characterize the thousands of comments provided.Over the summer we invited our Owners and Agents to complete a survey that addressed the challenges and successes around the COVID-19 pandemic. We received a great number of responses to the survey across all of the jurisdictions in which we operate. The results from the survey have been shared with the various HUD field offices. This article focuses on the comments provided to questions.

Comments shown are from the actual responses received. This information was important to share because, as part of the Multifamily Housing Program community, it is important that we learn and grow together through this pandemic.

The greatest challenge we have overcome:

- Getting food to our residents was our greatest challenge. We came up with a plan which worked well for both residents and staff. It became more evident that people need people to thrive and be happy. Staff and residents found creative ways to connect.

- Some tenants were adamant on not letting staff in their unit but in some cases we needed to get the work completed depending on the severity. Before we attempt to start any Work orders my staff knew to call the tenant first and schedule when to come up.

- The greatest challenge was to figure out how to perform certain tasks without meeting in person with tenants as well as ensuring the safety of the residents. Finding/Hiring qualified individuals to work was a close second. Coverage for staff while they were self-quarantining or mandated due to possible exposure; limited staff availability to ensure increased sanitation and disinfecting efforts were met; enforcing masking and social distancing; explaining the pandemic and CDC recommendations and keeping tenants informed as recommendations changed

- There were many challenges that we faced as an industry. Perhaps one of the greatest ones that we worked through and overcame is providing the needed safety protocols and protections for our on-site team members. We were able to react quickly to order PPE materials for our team. Increased our messaging with our residents on changes to how to interact with our team members through signage, emails, and written correspondence. Additionally, we implemented modifications to the layouts of our offices to increase distancing between team members, provide areas to meet with residents in a distanced environment, and added glass dividers to help provide an additional layer of protection. We feel that these measures when a long way to make our team members, who are essential workers, feel more comfortable coming to work, performing their regular duties, and interacting with our residents.

The greatest challenge we still face:

- As things began to open up more in the spring/summer timeframe, one of the challenges that we are facing is how to increase our engagement with residents, while being COVID sensitive. We are steadily working to incorporate event programming back at our communities. Our social services team is re-engaging with our residents to help them with education and employment initiatives, rental assistance programs, and general services that we had in place previously. We are excited to see increased activity and hope to continue making strides in getting back to normal.

- Delayed repairs and maintenance since tenants were fearful to let crews into their apartments. Fearful when we have a REAC inspection what they will find since we could not make annual inspections. Also since most people are staying home there are a lot of noise complaints and all we can do is beg tenants to be respectful. We cannot take anyone to court in New York so we cannot help the suffering tenants

- I am having difficulty locating vendors to show up, or provide free estimates, and limited staff with hesitancy to enter units with covid issues, surrounded by fear and hesitation, morale is really low and negativity is ramped. Suppliers having difficulty locating parts like generators, prices have increased due to fuel expenses etc and those are being passed on. Rents have not increased but costs have increased. **HUD should suspend reserve deposits temporarily (automatically).

- Rent collection has been an issue. We have received a great amount of funds from the various government sponsored relief programs but not being able to evict residents who won't apply for the funds is impacting operations.

- Switching residents to automatic or electronic payments, versus collecting old-fashioned checks and money orders. Very few people write checks anymore. We are looking into popular payment apps like VENMO. Also looking at adding an option to pay with credit/debit cards. This saves time and money for residents, especially the elderly, who would normally make a special trip to get a money order just for rent.

Our greatest success:

- Completed a lease up during the height of covid over the months January - March in the mid-Atlantic, which is a pretty big deal!

- Encouraging our residents to communicate with emails and by phone/texts. This was a natural switch for a generation used to being efficient with electronics.

- For the most part, residents and staff appreciate each other more. We found we can be creative to make life go on under depressing and sometimes scary moments.

- Our greatest success has been able to feed and provide outreach and resources to our residents.

- Our staff was fearless yet careful in this pandemic. And during the pandemic still provide quality yet safe care for all residents.

- The employees that haven't quit are the true lovers of this industry.

- We have all learned to appreciate the work we all do.

The most important best practice we can share with others:

- Be patient. There is other ways to gather information. The residents live in the building so leaving documents on the door worked for us.

- It is critical to identify the most vulnerable households ahead of time. Know in a crisis who is needed to be called to ensure all residents have needed resources and support.

- My staff and I delivered a memo every week to every tenant advising them of the status of Covid and what we must be done to keep all tenants Covid free. Every week they knew someone was there and looking out for them to try to keep them safe. All my tenants are seniors with average age of 83. They needed guidance, reassurance and support. Communication with my tenants was most important and they were very grateful.

- There have been a number of unintended outcomes we have experienced that we will permanently initiate going forward (post-COVID) including a higher level of "by appointment only" prospect engagement as well as more virtual leasing and Resident engagement and more flexible staffing models.

- To send our recertification packets and requests for document signage and highlighting all the areas that need initialed, signed and dated in order to make the process smooth. Also, giving and following up with the deadlines on when the paperwork needs to be returned to the office.

- What we have found to be a best practice is to over-communicate. It was a challenging time for all of us, but we found that being proactive and maintaining high levels of communication with our residents helped our residents and on-site team members. We also put a high degree of focus on health and wellness services, which we made an impact at our communities.

- Zoom communications for staff and owners entities

The most important best practice we would like to learn from others:

- Best methods and companies for collecting rent with no contact and NO CHECKS/MONEY ORDERS.

- How are they obtaining their talent (new employees) to work on their properties?

- How others have been dealing with rent collection issues.

- How they dealt with property supplies and orders being backordered and not arriving timely.

- How to safely increase resident participation in activities as it relates to wellness and mental health.

- How to utilize technology more effectively to operate our business either in person or remotely and still remain in full compliance with all requirements. Due to the hiring challenges how to effectively train employees with limited or no property management or compliance background. It seems to be the new norm.

- I would like to learn from others how to inspire them to be there better selves.

- Strategies for catching up on a potential backlog of maintenance needs.

- We would like to learn how other companies continued their programming throughout COVID. We see such value in programming at our communities and if anyone has any success stories there, it would be great to know what they found worked well.

- All Residents of HUD Subsidized Properties

-

CGI provides Project-Based Section 8 Contract Administration services to the NYS Housing Trust Fund Corporation and is responsible for responding to resident concerns. CGI Call Center has a team of Customer Relation Specialists (CRS) that will receive, investigate and document concerns such as, but not limited to the following:- Questions or concerns regarding work order follow-up.

- Questions regarding the calculation of your rent.

- Address health & safety and HUD Handbook 4350.3 concerns.

Call Center Purpose

- Call Center aids in ensuring HUDs mission of providing Decent, Safe and Sanitary Housing.

- Serves as a neutral third party to residents, owners and the public.

- Assists with clarifying HUD Occupancy Handbook 4350.3 requirements.

Call Center Contact Information and Business Hours

Hours of Operation: 8:30am to 5:30pm

Contact Numbers: 1-866-641-7901 TTY number: 1-800-662-1220 Fax: 518-218-7800

Written Summaries: 100 Great Oaks Blvd. Suite 120, Albany, NY 12203

Email: NYPBCAContactCenter@cgifederal.com

Website: http://www.pbcany.comConcerns can be submitted by the following:

- Phone

- Fax

- Voicemail

- FOIA- Freedom of Information Act request must be submitted directly to HUD

Required Information to open an inquiry

- Property name

- Caller’s name (anonymous calls accepted)

- Caller’s telephone number with area code

- Caller’s address including apartment number

- A brief, detailed description of the caller’s concern(s)

- Wishing you a warm and healthy Fall Season!