The CA Quarterly Review (Spring 2022)

THE NEWS AND INFORMATION QUARTERLY FOR OWNERS AND AGENTS OF THE PERFORMANCE BASED CONTRACT ADMINISTRATION FOR NEW YORK STATE

- Overview of the Active Partners Performance System (APPS)

-

We are seeing a high volume of multifamily applications due to ownership transfers and Chapter 15 bankruptcy filings. This article provides an overview of the form HUD-2530 Previous Participation Certification and the Active Partners Performance System (APPS)

Prospective entities and individuals that want to take an active role (e.g. owners, managing agents etc.) in HUD multifamily and healthcare projects must certify records of previous participation in HUD/USDA- FmHA, State and Local Housing Finance Agency projects by submitting form HUD-2530 to HUD before project application or participation can be approved.

The purpose of the Previous Participation Certification process is to ensure that prospective participants in HUD's Multifamily Housing Programs have a history of carrying out their past financial, legal, and administrative obligations in a satisfactory and timely manner.

Active Partners Performance System (APPS) is a web-based application that enables industry business partners to submit form HUD-2530 electronically and enables HUD staff to conduct Previous Participation Reviews with less administrative burden.

APPS replaced the prior 2530 paper process and provides a more efficient approval process. App secures and protects data through an ID and password process. The 2530 is submitted to the Field Office via Apps and HUD’s Previous Participation Review is a fully automated process. Apps searches and allows the Field Offices to view all flags found on an entity or individual. Entities may also use Apps to maintain updated contact information.

For questions about APPS contact the Multifamily Housing Systems Help Desk by phone at (888) 297-8689 option 5 or email.

Additional resources:

Multifamily Online Systems

APPS Industry User Guide

APPS Quick Tips

Headquarters 2530 Contacts

2530 Regulations

Processing Guide - Annual Unit Inspections

-

Owners and Agents are reminded that annual unit inspections must be completed. HUD has not authorized any waivers in regards to inspection requirements due to the pandemic as noted in the COVID-19 Multifamily FAQ below. Tenant and landlord unit access requirements are outlined in paragraph 20 of the HUD Model Lease.

Q4: During tenant file reviews, owners are concerned about being penalized on MORs for not having conducted annual unit inspections due to COVID-19. Will HUD forgo annual inspections for the tenant files represented at Addendum A, Section C, question 7 of form HUD-9834?

A: HUD will not waive the requirement for an owner to perform annual unit inspections at this time. Per HUD Handbook 4350.3, REV-1, paragraph 6-29.A.3, owners perform unit inspections on at least an annual basis to determine whether the appliances and equipment in the unit are functioning properly and to assess whether a component needs to be repaired or replaced. If local or state health department COVID-19 guidance prevents owners from entering a unit, the owner should consult with the tenant to confirm if there are any issues with appliances, equipment, or other components in the unit and document the tenant’s reporting. Owners may also consider utilizing electronic means to perform remote or virtual unit inspections and as a means of submitting work orders to minimize in-person interactions during the pandemic, when possible. (Added 1/4/21)

Q5: What should owners/property managers do if tenants refuse entry to inspectors, citing fears of COVID-19?

A: Until federal, state, or local public health officials counsel otherwise, owners and agents should follow published guidance covering apartment inspections. In this case, Paragraph 20 of the HUD Model Lease covers the rules governing the landlord’s access to a tenant’s apartment. (Updated: on 3/12/20) - Encourage Residents at HUD-Assisted Properties to File their Taxes for the Child & Earned Income Tax Credits

-

As part of the American Rescue Plan to help families through the pandemic, parents and guardians are eligible for up to $3,000 or $3,600 per child depending on the child’s age through the Child Tax Credit and many adults are eligible for additional money though the Earned Income Tax Credit.

As part of the American Rescue Plan to help families through the pandemic, parents and guardians are eligible for up to $3,000 or $3,600 per child depending on the child’s age through the Child Tax Credit and many adults are eligible for additional money though the Earned Income Tax Credit.

The Child Tax Credit and Earned Income Tax Credit are large tax refund payments that people can receive if they file a tax return. These tax credits are not income. Receiving these benefits will not impact eligibility for other federal benefits.

The best way to receive these benefits is to file a tax return before April 18, 2022.

Here is a flyer with more information (English and Spanish) and some places to go to get free help filing your taxes.

Here is how you can determine if you are eligible or find free resources to help you file for the credit. - Impact of Rising Utility Costs on Residents of Multifamily Housing Programs

In response to the U.S. Department of Energy forecasting a three-year high in 2022 for average residential utility costs across the U.S., the Office of Multifamily Housing has developed this flyer that includes helpful resources for owners and management agents to maintain compliance with HUD’s utility allowance calculation requirements and to improve energy at Multifamily properties.

In response to the U.S. Department of Energy forecasting a three-year high in 2022 for average residential utility costs across the U.S., the Office of Multifamily Housing has developed this flyer that includes helpful resources for owners and management agents to maintain compliance with HUD’s utility allowance calculation requirements and to improve energy at Multifamily properties.

Owner/Agents are encouraged to review HUD Notice 2015-04 for baseline UA requirements. Requesting utility data timely, either directly from the utility company or from the residents, will help to expedite the UA adjustment process.

For more information or if you have questions on utility allowances, please contact your local HUD office or your Contract Administrator.

- FY 2022 Annual Adjustment Factors

-

On February 16, 2022, a Notice of the Revised Contract Rent Annual Adjustment Factors (AAFs) for FY 2022 was published in the Federal Register.

The FY 2022 AAFs are effective February 16, 2022.

A copy of the Federal Register Notice containing the revised AAFs is located here.

The HUDUSER website has been updated to include the revised AAFs and can be viewed at: Annual Adjustment Factors - Lease Addendums

-

The lease is a legally binding contract between an owner and the tenant. Owners must use one of the four model leases prescribed by HUD. The type of lease used by an owner depends on the program being administered. The two most common leases used are the Family Model Lease (90105a) and the Model Lease for Section 202/8 or Section 202 PACs (90105b). The model leases identify the program requirements that owners and tenant must adhere to while participating in the program. Owners are not to make any changes or modifications to the HUD model lease.There are certain attachments and addendums to the lease that HUD does require. The main one being the Violence Against Women and Justice Department Reauthorization Act of 2005 Lease Addendum (VAWA HUD-91067). This must be signed by all adult members of the household and attached to the model lease.

The following are required attachments to the model lease:

- HUD 50059 signed by the tenant and owner,

- UD 50059A signed by the owner and, when applicable, by the tenant,

- Move-In inspection signed by the owner and tenant,

- House Rules, (If developed)

- Pet Rules (if applicable),

- Owner’s Live-In Aide addendum (if applicable),

- Owner’s Police or Security Personnel addendum (if applicable),

- And the VAWA Lease Addendum

Lease modifications are done by creating and using a lease addendum. Since the addendums are modifying the model lease, they are just as legally binding in regards to tenancy requirements. Because of this, HUD requires that most lease addendums are approved by HUD before implementation. Please review the Lease Q&A and Chapter 6 of the 4350.3 for possible exceptions to this requirement.

HUD will not allow modifications to the following nine provisions of the model lease:

- Changes in Tenant Rent,

- Regularly Scheduled Recertifications,

- Reporting Changes between Regularly Scheduled Recertifications,

- Removal of Subsidy,

- Tenant Obligation to Repay,

- Discrimination Prohibited,

- Changes in Rental Agreement,

- Termination of Tenancy, and

- Penalties for Submitting False Information.

A lease change provided by HUD Headquarters through the issuance of Notices or revisions to the handbook must be incorporated into the lease as a lease addendum. Lease changes and/or new lease addendums issued directly from HUD Headquarters do not required additional HUD Field Office approval. A modification to the lease may only be effective at the end of the lease term. The tenant must be provided the approved modifications at least 60 days prior to the end of the lease term. The notice to the tenant must include a copy of the revised lease or the new addendum revising the existing lease agreement. A letter must be included clearly stating that the tenant can either accept the modification or move, but they must respond within 30 days of the letter. The tenant will either accept the modification by signing and returning the updated lease or addendum, or, they will refuse the modification and give 30 days’ notice of intent to vacate.

The proposed lease addendum must be submitted to the local HUD Field Office for review. Two copies of the proposed lease addendum along with an explanation for the need of the lease addendum. If the proposed lease addendum is approved, then the notification process noted above must be followed.

- Monthly HAP Voucher Submissions

-

Part of the obligation in operating a Section 8 Multifamily Housing property is that you comply with the monthly HAP Voucher Submission requirements. To facilitate a smooth transmission each month, the PBCA has the below recommendations for processing your monthly HAP voucher.- Remember that HUD requires vouchers to be submitted by the 10th of the month. Many vouchers will require a draft reconciliation for corrections to be made, which can delay processing. Please submit your vouchers timely each month to avoid any processing delays

- Audit and thoroughly review your monthly HAP voucher and certifications prior to transmission TRACS to ensure accuracy of billing.

- It is the owner’s responsibility to ensure that each tenant’s eligibility and assistance payment are computed in accordance with HUD regulations, administrative procedures, and the HAP Contract.

- Submit requested corrections for any draft reconciliation report within 3 business days.

- Communicate early and often with your assigned Contract Specialist regarding any processing issues you may be experiencing.

Reach out to your Contract Specialist with any voucher related questions, they are there to assist!

- PBCA Member Spotlight

-

Shelly Dunn— Contract Specialist—Upstate NY

Shelly Dunn— Contract Specialist—Upstate NYExplain your position with CGI?

I am a Contract Specialist. I work with owner/agents of 57 properties while working on their rental adjustments, special claims, vouchers, contract renewals, and provide assistance as needed to the owner/ agents.How long have you been with CGI?

October 2, 2022 will be my 5 year anniversary.What was your background prior to joining CGI?

I was a supervisor at Maximus. We processed documents and determined eligibility to applicants for affordable health plans for the NYS Dept. of Health.What are your hobbies? Things you enjoy doing after you leave the office?

I love the beach and the water in the summer. My family and I try to go camping as much as possible when it is nice out. During the colder months I enjoy more inside activities such as playing pool and I actively go to the gym, which I also enjoy.What brings you the most satisfaction in your day to day tasks?

I enjoy being a part of a company like CGI and their core values. Helping owners and agents to continue offering subsidized housing to the community is a wonderful and fulfilling experience that I get to be a part of everyday.What is the best piece of advice that you could provide to an owner/agent?

Communication is key. If you need assistance please reach out. We are more than happy to assist if we can. Also there is a lot of useful guidance at PBCANY Home including forms you will need, announcements, events, the HUD handbook, and many other items to assist you. - Spring Cleaning– Records Retention Requirements

-

Since more tenants move in during the spring and summer months, this gives property managers and landlords a perfect reason to conduct a thorough spring cleaning of files. This article will discuss retention requirements as well as purging of documentation.

Applicant File Retention – HUD Handbook 4350.3 Chapter 4, 4-22

Applicant Files must be maintained from the time the application is accepted, through the wait list period and for three years after the applicant is removed from the waist list.- The current application must be retained as long as applicant is active on the waiting list.

- If the applicant was removed from the waitlist, then the application, supplement to application (HUD 92006), initial rejection notice, applicant reply, copy of the owners final response and all documentation supporting the reason for removal must be retained for three years.

- After an applicant moves in to the property the application and supplement to application (HUD 92006) must be maintained in the tenant file for the term of tenancy plus three years.

Resident File Retention – HUD Handbook 4350.3 Chapter 5, 5-23

Owners must keep the following documentation in the resident file:

Resident files (all documentation) must be maintained for the term of tenancy plus three years thereafter.- All original, signed HUD 9887s and 9887As;

- A copy of signed consent forms;

- A copy of the EIV Income Report, the HUD 50059 and any other documentation obtained supporting rent and income determinations; and

- Any third party verifications

Retention of EIV Reports – HUD Handbook 4350.3 Chapter 9, 9-14

- The Income Report, Summary Report and the Income Discrepancy Report along with any supporting documentation must be retained in the resident file for the term of tenancy plus three years.

- Any tenant provided documentation to supplement the Social Security Administration or National Database of New Hires data must be retained in the resident file for the term of tenancy plus three years.

- Results of the Existing Tenant Search must be retained with the application:

- If the applicant was not admitted, it must be retained with the application for three years.

- If the applicant was admitted, it must be retained in the resident file for the term of tenancy plus three years.

- The master file containing the New Hires Report, Identity Verification Reports, Multiple Subsidy Report and Deceased Tenant Report must be retained for three years

Once the retention period has expired for all of the above listed requirements, owners must dispose of the data in a manner that will prevent any unauthorized access to personal information (shred, burn, pulverize, etc.). It is recommended to review the above requirements once a year to ensure unnecessary documentation is being kept and stored on-site.

Many residents may reside at a property for multiple years and this will cause the resident file to become quite large. Owners may choose to move reduce the files sizes located at the property; however, it is recommended to keep all move-in documentation along with the most recent five years’ worth of recertifcations. If file documentation is removed from the property it must be kept in secure storage, the documentation cannot be destroyed. It is recommended to include this policy in an owner/agents written management procedures. - Race and Ethnic Data Reporting Form

-

On February 15, 2022, Form HUD-27061-H, Race and Ethnic Data Reporting Form, was re-published to HUDCLIPS. This form is used by applicants and in-place tenants of Multifamily Housing programs to provide self-certification of race and ethnicity for data collection purposes. Please see HUD Handbook 4350.3 for more information on Form HUD-27061-H. In the interim, Owners/Agents should refer to the information at the bottom of the form for instructions on who should complete the form, when the form should be completed, and how the form should be stored in a household’s file.

On February 15, 2022, Form HUD-27061-H, Race and Ethnic Data Reporting Form, was re-published to HUDCLIPS. This form is used by applicants and in-place tenants of Multifamily Housing programs to provide self-certification of race and ethnicity for data collection purposes. Please see HUD Handbook 4350.3 for more information on Form HUD-27061-H. In the interim, Owners/Agents should refer to the information at the bottom of the form for instructions on who should complete the form, when the form should be completed, and how the form should be stored in a household’s file. - Voting Rights and Access for Residents at HUD-Assisted Properties

-

The Office of Multifamily Housing Programs is making multifamily owners/agents of HUD-assisted properties aware that residents have the right to access voter registration activities and to participate in the electoral process. HUD is asking owners/agents to share voter and election resources with residents, including encouraging residents to visit vote.gov, a website that provides helpful information, including how to register to vote, voter registration deadlines, and specific information about state and local elections.As many rules about voting are set by states, owner/agents should check with their counsel to ensure that all activities are compliant with local and state law.

Permissible activities at Multifamily-assisted properties include:

- Permitting the use of community space on an incidental basis to hold meetings, candidate forums, or voter registration, provided that all parties and organizations have access to the facility on an equal basis and are assessed equal rent or use charges.

- Collaborating with local election administrators to permit the use of space for voter drop boxes and voting sites, including for early voting.

Owners/agents may not use Section 8, PRAC, or project funds to finance the use of facilities or equipment for partisan political purposes or partisan political activities that favor one candidate, party or political position over another. Any voter registration activities undertaken should not be partisan.

Impermissible activities include any act that would:

- Suggest that benefits are in any way tied to a participant’s voting activity, or

- Give the appearance that the processes of voter registration or voting are not voluntary processes.

You are reminded that federal laws, including Section 504 of the Rehabilitation Act of 1973 (Section 504) and Titles II and III of the Americans with Disabilities Act of 1990 (ADA), require that the voting process, including voter registration, site selection, and casting ballots be accessible for individuals with disabilities. For example, any community space used for voting access must be accessible. See The Americans with Disabilities Act and Other Federal Laws Protecting the Rights of Voters with Disabilities for additional information.

Thank you for your commitment to making sure that HUD-assisted residents have access to this important information.

- Carbon Monoxide Alarms or Detectors Required in HUD-Assisted Housing Programs Effective 12/27/2022

-

On January 31, 2022 HUD’s Offices of Public and Indian Housing, Multifamily Housing Programs, and Lead Hazard Control and Healthy Homes posted a joint Housing Notice H-2022-01 requiring carbon monoxide alarms or detectors in their HUD-assisted housing programs starting December 27, 2022.Owners of properties that receive federal rental assistance have an important role to prevent potential loss of life and severe injury associated with carbon monoxide (CO) in housing they own or manage. Housing Notice H-2022-01 clarifies that HUD will enforce the requirements instituted by Congress of Section 101, “Carbon Monoxide Alarms or Detectors in Federally Insured Housing” of Title I of Division Q, Financial Services Provisions and Intellectual Property, of the Consolidated Appropriations Act, 2021, Pub. L. No. 116-260, 134 Stat. 2162 (2020) (“the Act”), that requires CO alarms or detectors be installed in certain HUD-assisted housing within two years of enactment and in a manner that meets or exceeds the standards described in Chapters 9 and 11 of the 2018 publication of the International Fire Code (IFC).

Housing Notice H-2022-01 also:

- Reminds owners and operators of Project Based Rental Assistance (PBRA), Public Housing, Housing Choice Vouchers (HCV), Project Based Vouchers (PBV), Supportive Housing for the Elderly (Section 202) and Supportive Housing for Persons with Disabilities (Section 811) properties of carbon monoxide poisoning risks in housing;

- Identifies resources for preventing and detecting exposure;

- Provides notice of the requirement for alarms or detectors to be installed in certain HUD-assisted housing by December 27, 2022; and

- Provides initial information and guidance to assist O/As with educating tenants on health hazards in the home, including CO poisoning, lead poisoning, asthma induced by housing-related allergens, and other housing-related preventable outcomes, to help advance primary prevention and prevent future deaths and other harms.

HUD plans to develop CO materials that will be posted to HUD’s website and available for download without cost. O/As must read the full Notice H-2022-01 here.

Here are more resources for additional information:

HUD’s Office of Lead Hazard Control and Healthy Homes (OLHCHH) https://www.hud.gov/program_offices/healthy_homes/healthyhomes/carbonmonoxide

Centers for Disease Control and Prevention (CDC)’s Carbon Monoxide Poisoning information webpage https://www.cdc.gov/co/default.htm

Consumer Product Safety Commission (CPSC) Carbon Monoxide Fact Sheet

https://www.cpsc.gov/safety-education/safety-guides/carbon-monoxide/carbonmonoxide-fact-sheet

CPSC Carbon Monoxide

https://www.cpsc.gov/Safety-Education/Safety-EducationCenters/Carbon-Monoxide-Information-Center

- Updated Housing Notice 2015-04 FAQ Published

-

On February 10, 2022, the Office of Multifamily Housing posted to HUDCLIPS updated responses to frequently asked questions (FAQs) regarding Housing Notice H-2015-04, Methodology for Completing a Multifamily Housing Utility Analysis.

On February 10, 2022, the Office of Multifamily Housing posted to HUDCLIPS updated responses to frequently asked questions (FAQs) regarding Housing Notice H-2015-04, Methodology for Completing a Multifamily Housing Utility Analysis.

The updated FAQs are now located on HUDCLIPS under Housing Notice H-2015-04: https://www.hud.gov/sites/dfiles/OCHCO/documents/UA_FAQs_February_2022.pdf

Questions 31, 42 and 43 are new additions to the FAQ:

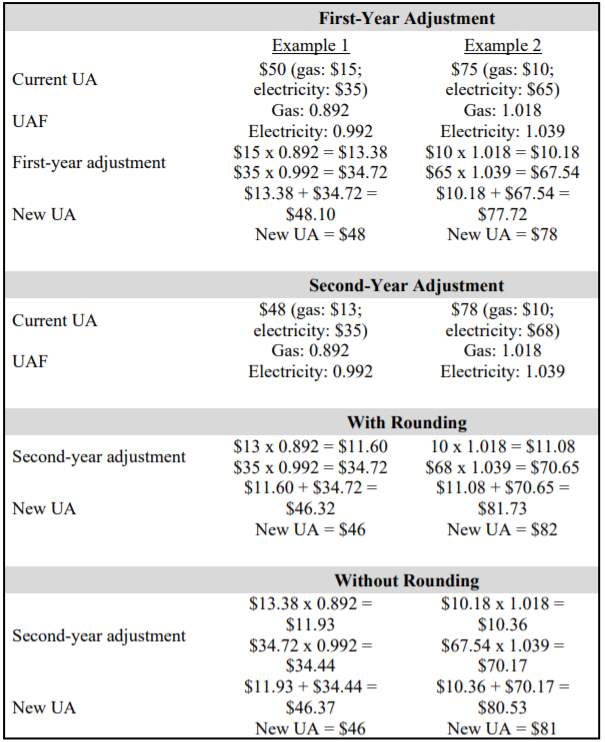

31. NEW: Question: In the years in which O/As perform a factor-based analysis, do O/As take the previous utility allowance before rounding or after rounding and then apply the factor?

Answer: Calculate the new UA both ways, with and without rounding. The new UA will be whichever method provides the higher UA. The table below shows two examples. Example 1 results in a UA of $46, both with and without rounding. The UA will therefore be $46. In Example 2, the UA with rounding results in a UA of $82; without rounding, the UA is $81. The UA will therefore be $82.

42. NEW: Question: Some O/As issue the utility reimbursements on debit cards. In a few cases, tenants have never activated their cards even though they have been notified several times to do so. They have several hundred dollars on the cards. Would O/As pull the money back off the cards and return it to HUD after giving the tenant proper notice or just leave it on the card continuing to accumulate?

Answer: The balance must be left to accumulate on the debit card. For utility allowance reimbursements, once a check is made payable to the tenant, or funds are deposited to a tenant’s debit card, ownership of the funds passes to the tenant. HUD does not receive the funds back, nor does the owner.

43. NEW: Question: For RAD conversions that have both PBRA and PBV units, which units should be selected for the RAD PBRA baseline utility analysis?

Answer: The sample selected should include only units covered under the RAD PBRA HAP Contract. Again, these are two distinct programs, and the unit samples should not overlap. - All Residents of HUD Subsidized Properties

-

CGI provides Project-Based Section 8 Contract Administration services to the NYS Housing Trust Fund Corporation and is responsible for responding to resident concerns. CGI Call Center has a team of Customer Relation Specialists (CRS) that will receive, investigate and document concerns such as, but not limited to the following:- Questions or concerns regarding work order follow-up.

- Questions regarding the calculation of your rent.

- Address health & safety and HUD Handbook 4350.3 concerns.

Call Center Purpose

- Call Center aids in ensuring HUDs mission of providing Decent, Safe and Sanitary Housing.

- Serves as a neutral third party to residents, owners and the public.

- Assists with clarifying HUD Occupancy Handbook 4350.3 requirements.

Call Center Contact Information and Business Hours

Hours of Operation: 8:30am to 5:30pm

Contact Numbers: 1-866-641-7901 TTY number: 1-800-662-1220 Fax: 518-218-7800

Written Summaries: 100 Great Oaks Blvd. Suite 120, Albany, NY 12203

Email: NYPBCAContactCenter@cgifederal.com

Website: http://www.pbcany.comConcerns can be submitted by the following:

- Phone

- Fax

- Voicemail

- FOIA- Freedom of Information Act request must be submitted directly to HUD

Required Information to open an inquiry

- Property name

- Caller’s name (anonymous calls accepted)

- Caller’s telephone number with area code

- Caller’s address including apartment number

- A brief, detailed description of the caller’s concern(s)

- Happy Spring!