The CA Quarterly Review (Winter 2021)

THE NEWS AND INFORMATION QUARTERLY FOR OWNERS AND AGENTS OF THE PERFORMANCE BASED CONTRACT ADMINISTRATION FOR NEW YORK STATE

- Utility Assistance Programs Reminder

-

As a PBCA we have seen an influx of Baseline Utility Allowance submissions this year for FY 2022. The purpose of this article is to specifically focus on the submission to the PBCA. Here are a few reminders regarding Utility Provider Assistance Programs such as HEAP/EAP/UA Assistance programs:- The credits for HEAP/EAP/UA assistance programs should be added back into the UA bills. Therefore when you are calculating your Utility Allowance for a tenant, and the resulting UA after the credit of HEAP/EAP/Assistance results in a bill of $0 or negative numbers or anything other than the actual usage amount, be sure to add those credits back in. The UA for that tenant receiving HEAP/EAP/UA assistance should not be reduced by the credit being received by the tenant. Tenants should receive both the full UA from HUD and the HEAP/EAP credit.

- For example: Tenant Usage bill is $125 – HEAP $30 – EAP $10 = $85 Bill amount. UA amount used in the Baseline submission should be usage of $125 (85 + 30 + 10= 125).

- If you receive a monthly average from the utility company (vs. actual bills) for a tenant and the tenant’s bill results in a $0 month, follow up with that tenant to find out if they receive HEAP/EAP/Assistance. This is especially true for multiple $0 month bills/averages.

- In order to expedite the baseline UA process, be sure to give details to your PBCA as to why there are bills with $0 or negative numbers or skipped months.

- Understand that when you have provided a summary with $0 or negative months for usage, your CCS may request an updated Summary/Bills and further details for why the month’s usage resulted in $0 or negative bills. This is how the PBCA will confirm assistance programs such as HEAP/EAP/ Assistance.

- Do not omit tenants receiving a UA assistance such as HEAP/EAP/UA Assistance credits.

- Owners are required to retain UA bills for tenants for life of tenancy plus 3 years.

- Never include late fees in your UA Calculations.

- Always include Taxes in your calculations.

- The credits for HEAP/EAP/UA assistance programs should be added back into the UA bills. Therefore when you are calculating your Utility Allowance for a tenant, and the resulting UA after the credit of HEAP/EAP/Assistance results in a bill of $0 or negative numbers or anything other than the actual usage amount, be sure to add those credits back in. The UA for that tenant receiving HEAP/EAP/UA assistance should not be reduced by the credit being received by the tenant. Tenants should receive both the full UA from HUD and the HEAP/EAP credit.

- Preventative Maintenance

-

You’ve probably heard the expression, “If it ain’t broke, don’t fix it.” When managing building maintenance, this may work for a short period of time but eventually everything will break. Reactive Maintenance is the process of repairing major mechanical systems and equipment and restoring apartments and equipment to standard operating conditions after poor performance or breakdown is observed. If your maintenance staff operates on a reactive approach to maintenance, it’s time for change.Each project is required to have a Preventative Maintenance (PM) Schedule in place. The purpose of PM is to ensure that major mechanical systems and equipment remain in good operable condition at all times. PM is planned maintenance work that is carried out according to a schedule to extend the life of systems and equipment and to prevent the deterioration of the property and grounds.

Development and Implementation

The first step in developing a PM policy is to identify items to include in the PM schedule. The PM policy should be detailed enough to identify which item is being inspected/serviced and its location.The PM schedule should be developed and prioritized based on manufacturers' recommendations, historical information, and seasonal considerations.

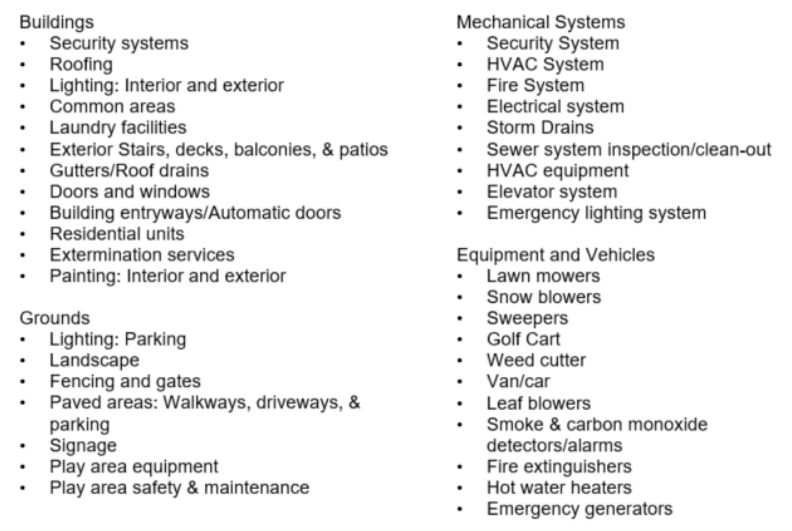

A PM Program should include:

- Annual unit inspections and repairs

- Regular inspections and upkeep of buildings and grounds

- Regular servicing of mechanical systems

- Regular servicing of equipment and vehicles

The PM frequency should be determined for all identified items. The PM work should be scheduled at the beginning of each year, ensuring that appropriate attention is given to all affected facilities and equipment. The schedule should also allow for problems to be identified and corrected. Work should be scheduled to permit sufficient time for completion of repairs prior to seasonal needs. For example, boiler and furnace work should be completed before the beginning of the heating season and roof work before the rainy season.

Taking preventative action to identify maintenance needs reduces the frequency and severity of breakdowns and service interruptions. The preventive maintenance inspections and work also assist to establish a record of deterioration which may signal modernization needs that can be systematically planned and scheduled. This maintenance will avoid waiting for a major crisis to occur before addressing a predictable problem.

What Items should be Included in the Preventative Maintenance Schedule?

Items to include in your PM Schedule will vary depending upon the design and amenities of the property. Below is a list of just a few items that could be incorporated in a PM Schedule:

O/As should trim trees and vegetation, prior to windy season, so as to not cause damage to the roof, clean gutters before rainy season, and service AC units in the spring, before summer.

Records

Owner/Agents (O/A) should have a system in place to identify when the PM tasks have been completed, the name of the staff person/contractor who conducted the task/inspection, and a process for ensuring that needed work is completed. O/As may create individual inspection reports, or checklists, for each mechanical system, equipment type, and/or building task that contains a description of the minimum elements of the inspection or service. For example, PM for a building may require activities such as painting wood and metal surfaces, caulking around doors and windows, roof repair, and removal of leaves from gutters.O/A’s schedule for PM will be reviewed during the Management and Occupancy Review (MOR). O/As should be prepared to provide their MOR Reviewer with a copy of their PM policies and procedures along with documentation to support the PM activities are completed as required.

Advantages, beyond those previously mentioned, include increased resident satisfaction, fewer complaints, and increased maintenance staff productivity, since the PM lessens the frequency of regular maintenance work and extraordinary repairs. Taking preventative action to extend the life of systems and equipment and to prevent the deterioration of the property and grounds is an essential part of managing maintenance!

- COVID-19 Test Kits are Available at Federally Qualified Community Health Centers

-

Are you a Multifamily owner/management agent? Would you like access to at-home rapid tests for residents? Then reach out to your federally qualified community health centers FQHC/community health center partners!The U.S. Department of Health and Human Services/Health Resources & Services Administration is making at-home COVID-19 rapid test kits available to their FQHC. FQHCs/community health centers will be able to request supplies on a regular basis to deliver at-home COVID-19 rapid tests to their patients and their community partners. This includes people experiencing homelessness and residents of HUD-assisted housing.

- PBCA Member Spotlight

-

Alicia Utberg—Team Leader—Upstate New York

Alicia Utberg—Team Leader—Upstate New YorkExplain your position with CGI?

I am currently the Upstate Team Lead where I manage a group of six Contract Specialists who process Contract Renewals, Rent Adjustments, Special Claims, Vouchers, etc. in our NY portfolio. I help my team and O/ As work through any issues with their process, offering guidance or resources when needed. I also work very closely with the departments that support Operations; Finance, Training & Compliance, Quality Assurance as well the HUD staff sending out executed documents, requesting and providing status updates or anything else that may be needed to finalize a process.How long have you been with CGI?

I started as a Contract Specialist with CGI in February 2008 and was promoted to Lead Contract Specialist in June 2012 and then Team Lead in October 2016.What was your background prior to joining CGI?

While attending undergraduate school at St. Rose for Sociology, I worked as a temp as a Tax Information Aide as the NYS Dept. of Taxation & Finance where I communicated daily with taxpayers and/or their representatives’ staff regarding their sales tax returns. I continued working there after graduating in May 2006. I then moved onto working as a Clerk II at the Research Foundation at SUNY which was short lived once I was hired at CGI in 2008.What are your hobbies? Things you enjoy doing after you leave the office?

With COVID I unfortunately don’t get out much during the winter months so when I get home I enjoy spending time with my two year old painting, playing with play-dough or just watching a movie with her and my husband. During the summer months I enjoy going camping with my family and visiting family out in western NY where my husband grew up.What brings you the most satisfaction in your day to day tasks?

Aside from being most proud with providing housing for those people in need, I also find satisfaction in providing much needed assistance to owners and agents when they are faced with issues at their property. Whether it be with a tenant’s 50059s, requirements with their HUD contract or documents needed for special claims, I get the most satisfaction when I am able to help an O/A work through a difficult issue as well as my team members in working through these issues with their owners/agents.What is the best piece of advice that you could provide to an owner/agent?

Communication! To provide the utmost support and assistance, communication between CGI and our O/ A’s is key to our joint success. - Utility Allowance Submission Reminders

-

On June 22, 2015, HUD released Notice H-2015-04: Methodology for Completing a Multifamily Housing Utility Allowance. The notice provided instruction to owners and agents (O/As) for completing the utility allowance analysis required at the time of the annual or special adjustment of contract rents and when a utility rate change results in a cumulative increase of 10 percent or more from the most recently approved UA. The notice immediately changed the way in which Utility Allowance Analysis were prepared and submitted. HUD has since released the corresponding FAQs to HUD notice 15-04.This article summarizes both the baseline and UAF requirements, as well as the tenant notification requirements when an implementing a decrease to the utilities or a change in the tenants rent.

Baseline Submission Requirements

HUD Notice 2015-04 instructs O/As to establish a baseline for each bedroom size once every three years. For two years after the baseline submission, utility allowances for each bedroom size and each utility type at the property will be adjusted by a state-specific increase factor called a Utility Adjustment Factor (UAF).To perform a baseline analysis, the O/A must perform the following steps:

Step One: Determine the required sample size. HUD outlines the minimum sample size in Figure 1 of the HUD notice 2015-04. The chart below outlines the minimum sample size per unit type. It is the responsibility of the O/A to make every effort possible to meet the minimum requirements.

Number of Units Minimum Sample 1 – 20

21 – 61

62 – 71

72 – 83

84 – 99

100 – 120 2

121 – 149

150 – 191

192 – 259

260 – 388

389 and above 29All

20

21

22

23

24

25

26

27

28

29Step Two: Obtain your samples. It is acceptable for you to receive and utilize multiple forms of documentation to support the baseline analysis. You can obtain data from the resident, the utility company, a third party provider, or a combination of the three. You must submit documentation to support how the new UA was calculated, this includes:

- Copies of the tenant data received from utility providers, usually in a summary format;

- Copies of printouts indicating a summary of monthly data if the tenant was able to obtain the data online or from the utility provider;

- If the O/A obtained actual monthly utility bills from a tenant, the O/A may submit a spreadsheet summarizing the average of the monthly bills. Actual utility bills may be requested at the discretion of HUD/CA. These bills, regardless of whether they are provided to HUD/CA, must be retained by the owner for three years;

- A combination of the above may be submitted.

Reminder: O/As must gather tenant data and retain the tenant data for the term of tenancy plus three years. A summary format (i.e. excel spreadsheet), as noted above, can be submitted using the collected tenant data without submitting the bill support documentation.

Note: The data submitted in your baseline submission should not be greater than 18 months old from the contract anniversary date.

O/As should develop management practices, as indicated in the HUD notice, on how to prepare for and accomplish the data collection requirements of the baseline Utility Analysis. It can be a challenging task to gather the UA data but the management practices should help assist in meeting this requirement. If a complete sample cannot be obtained, then an O/A must demonstrate that every effort was exhausted to obtain a complete sample and submit the collected data to the CA. It is the O/A’s responsibility to provide an analysis that follows the protocol outlined in the notice as closely as possible, recognizing that the “perfect” sample may not always be available.

It is the PBCA’s responsibility to make sure that the analysis justifies the resulting U/As, with whatever compromises in the sampling were necessary to achieve that analysis. Typically in these scenarios the PBCA will implement the new UA amounts as indicated by the analysis and the PBCA, in consultation with HUD, may require the owner to complete another baseline the following year.

Step Three: Determine if your samples are compliant. Certain units must be excluded from the sample:

- Those units receiving a UA as part of a reasonable accommodation;

- Those units having been vacant for 2 or more months. Units included in the sample must have at least ten months of occupancy;

- Those units receiving a flat rate utility as part of a low-income assistance program. An exception to this would be if all tenant at the property were receiving a flat rate utility assistance.

Step Four:

Use HUD’s sample UA worksheet or other calculation worksheet that uses HUD’s formulas for calculating the averages. Attachment A of HUD Notice 2015-04 is HUD’s sample UA worksheet. Be sure to enter the unit numbers in the vertical column and the months for each sample in the horizontal headers.

Do not remove the highest or lowest utility cost household when determining the average.

UAF Submission and Calculation

Per Notice H-2015-04, for years two and three, following the year the baseline UA is established, owner/ agents have the option to perform a factor-based utility analysis. Utility Allowance Factors will be effective on the same date as the OCAF, which is typically February 11 of each year. HUD will release the UAF factors at the same time as the OCAF factor.

Per HUD’s UA FAQ Guidance #33: Utility allowance regulations require an owner to “submit an analysis of the project’s utility allowances” for review and approval each year. This requirement extends to the factor based years in which an owner will show how the factor was applied and identify the resulting utility allowance recommendation.For projects with a Utility Allowance; when submitting an AOCAF package to the Contract Administrator (CA); owners should select the second checkbox on the AOCAF letter. This indicates that they are asking for one of the following options: 1) the AOCAF with a UAF adjusted utility allowance, including the written analysis to show how the factor was applied; or 2) the AOCAF with a baseline submission, with the necessary supporting documentation.

In factoring the UAF: owner/agents will determine their utility type and State specific UAF (Utility Allowance Factor) and apply the published UAF to their existing allowance to calculate the adjusted utility allowance amount.

Tenant Notification Requirements – Decrease in UA

HUD Notice 2015-04 requires that whenever an adjustment to the utility allowance results in a decrease, the owner/agent must follow the requirements of 24 CFR Part 245.405(a) and §245.410 regarding notice to tenants.Owner/agents must allow the required 30 day tenant comment period to expire prior to sending the submission to the CA. Any tenant comments received should be sent to the CA along with the submission, including the signed and dated Tenant Notice and the corresponding “Owners Certification as to Compliance with Tenant Comment Procedures in 24 CFR 245.” The owner’s certification should be dated after the 30 day notice was provided to the tenants.

Owners are encouraged to read and understand the tenant notice requirements Located at 24 CFR 245.410.

Per §245.410, a compliant notice must contain the following information:

a) The mortgagor intends to submit a request to HUD for approval of the covered action or actions specified in the notice;

b) The tenants have the right to participate as provided in §245.420, and what those rights are, including the address at which the materials required to be made available for inspection and copying under that section are to be kept;

c) Tenant comments on the proposed covered action may be sent by the mortgagor at a specified address or directly to the local HUD office, and comments sent to the mortgagor will be transmitted to HUD, along with the mortgagor’s evaluation of them, when the request for approval is submitted;

d) HUD will approve or disapprove the proposed action, based upon its review of the information submitted and all tenant comments received. In the case of a proposed reduction in tenant-paid utilities, the notice must also state that HUD may adjust the proposed reduction upward or downward;

e) In the case of a proposed conversion of residential units, partial release of mortgage security, or major capital additions to the project, the proposed action may require the owner to request HUD approval of a rent increase; and

f) The mortgagor will notify the tenants of HUD’s decision and it will not begin to effect any approved action (in accordance with the terms of existing leases) until at least 30 days from the date of service of the notification.Once 30 days has passed, the owner will be required to complete the Certification of Compliance with the Tenant Comment period. Both documents will be required to be submitted to the CA and copies are available in the Knowledge Center.

- All Residents of HUD Subsidized Properties

-

CGI provides Project-Based Section 8 Contract Administration services to the NYS Housing Trust Fund Corporation and is responsible for responding to resident concerns. CGI Call Center has a team of Customer Relation Specialists (CRS) that will receive, investigate and document concerns such as, but not limited to the following:- Questions or concerns regarding work order follow-up.

- Questions regarding the calculation of your rent.

- Address health & safety and HUD Handbook 4350.3 concerns.

Call Center Purpose

- Call Center aids in ensuring HUDs mission of providing Decent, Safe and Sanitary Housing.

- Serves as a neutral third party to residents, owners and the public.

- Assists with clarifying HUD Occupancy Handbook 4350.3 requirements.

Call Center Contact Information and Business Hours

Hours of Operation: 8:30am to 5:30pm

Contact Numbers: 1-866-641-7901 TTY number: 1-800-662-1220 Fax: 518-218-7800

Written Summaries: 100 Great Oaks Blvd. Suite 120, Albany, NY 12203

Email: NYPBCAContactCenter@cgifederal.com

Website: http://www.pbcany.comConcerns can be submitted by the following:

- Phone

- Fax

- Voicemail

- FOIA- Freedom of Information Act request must be submitted directly to HUD

Required Information to open an inquiry

- Property name

- Caller’s name (anonymous calls accepted)

- Caller’s telephone number with area code

- Caller’s address including apartment number

- A brief, detailed description of the caller’s concern(s)

- Happy New Year!

-